does florida have capital gains tax on real estate

The Three Types of Florida Real Estate Taxes. What is the capital gain tax for 2020.

/will-i-pay-tax-on-my-home-sale-2389003-v5-73871af4e690411c8fc3e03de02cb241.png)

Will I Pay Taxes When I Sell My Home

States have an additional capital gains tax rate between 29 and 133.

. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet. 1 week ago Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt. Make sure you account for the way this.

Its called the 2 out of 5 year rule. Special Real Estate Exemptions for Capital Gains. A majority of US.

What You Need To Know 2022. 250000 of capital gains on real estate if youre single. The profit you make on the sale of your capital asset is used to calculate your capital gains tax liability.

Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40401 and 445850 married filing jointly earning between 80801 and 501600 or head of. The rates listed below are for 2022 which are taxes youll file in 2023. The first 500000 of the gain is tax-free and the remaining 275000 is subject to capital gains tax rates of 15 or 20 depending on your income plus a 38 surtax for upper.

Ncome up to 40400. Make sure you account for the way this will impact your future profits which will have an impact on your capital gains tax when. Individuals and families must pay the following capital gains taxes.

There is no Florida capital gains tax on individuals at the state level and no state income tax. Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. The state of florida does not have a state income tax and it also does not have a capital gains tax regardless of your state of residency.

It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. 500000 of capital gains on real estate if youre married and filing jointly. Federal long-term capital gain rates depend on your.

If you owned and lived in the place for two of the five years before the sale then up to. Florida does not have state or local capital gains taxes. It depends on how long you owned and lived in the home before the sale and how much profit you made.

If you sell a 500000 piece of commercial real estate at 250000. Long-term capital gains tax is a tax applied to assets held for more than a year. The long-term capital gains tax rates are 0 percent 15.

Florida has no state income tax which means there is also no capital gains tax at the state. Capital Gains Taxes Considerations for Selling Florida Real Estate. The IRS typically allows you to exclude up to.

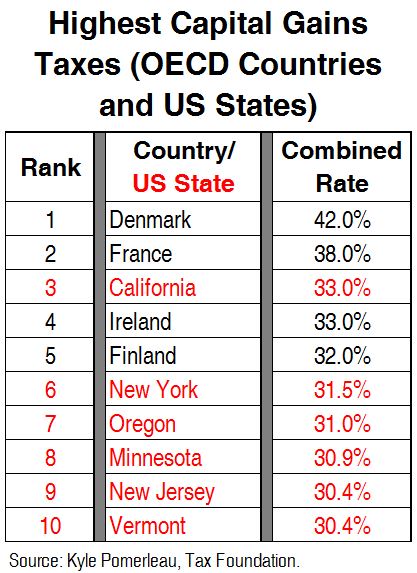

Heres an example of how much capital gains tax you might. The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the marginal.

Tax Implications Of The Florida Lady Bird Deed Ptm Trust And Estate Law

Tax Tips For Selling A House In Florida Florida Cash Home Buyers

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Home Sale Exclusion Tax Savings On Capital Gain Of A Principal Residence

Capital Gains On Real Estate How Can Florida Realtors Help Jc Realty Group Inc

Crypto Capital Gains And Tax Rates 2022

Biden Proposal Would Close Longtime Real Estate Tax Loophole Mansion Global

Capital Gains Full Report Tax Policy Center

2022 Income Tax Brackets And The New Ideal Income

Capital Gains Tax On Real Estate Kiplinger

The States With The Highest Capital Gains Tax Rates The Motley Fool

State Taxes On Capital Gains Center On Budget And Policy Priorities

How To Avoid Capital Gains Tax When Selling Your Home

Short Term And Long Term Capital Gains Tax Rates By Income

Capital Gains Tax What Is It When Do You Pay It

What Is The 2 Out Of 5 Year Rule

Selling Foreign Property Abroad How Does It Reflect On Your Taxes Taxes For Expats